Welcome to THE CA DESK - Your Trusted Partner

The holding company-subsidiary company corporate structure is extremely popular all across the world. All large companies serve as holding companies. For instance, Apple Inc. is a holding company which is registered in the United States. Apple has several subsidiaries all across the world. Companies like Apple China and Apple Russia are registered in their respective countries.

This structure is used by all multinational companies in the world. They have subsidiary companies which conduct business in different parts of the globe and then send their profits back to the holding corporation. This structure has become popular because there are several tax and operational benefits that accrue as a result of this structure.

What is a Holding Company?

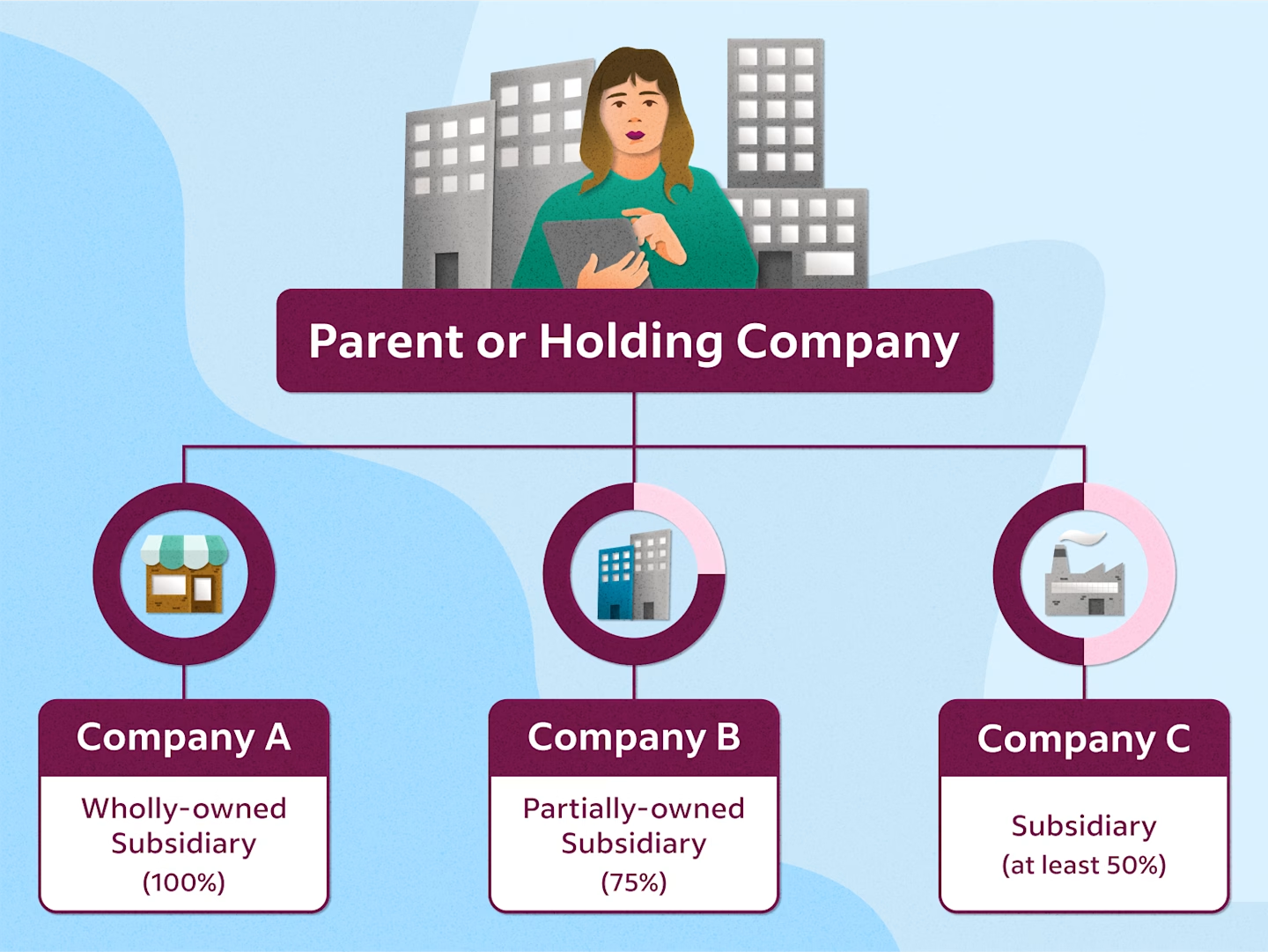

A holding corporation is a parent corporation. This means that the holding corporation owns majority shares in other companies. As a result, the holding company can appoint the board of directors of the subsidiary company. This means that the holding corporation is in complete control of the policies and workings of the subsidiary company.

Also, since the holding company owns majority stock in the operations of the subsidiary company, it can receive the profits from transfer it to the parent company. Based on the needs of the shareholders, the profits can either be retained in the subsidiary company or they can be transferred using the holding company. Thus, the holding company structure provides flexibility to the shareholders.

Types of holding companies

There are two important categories of holding companies: the operational holding and the financial holding company. These can further be divided into pure, mixed, immediate, and intermediate holdings. The main differences between companies acting as holdings in India are:

- the pure company will be created for the sole purpose of owning stock in its subsidiaries;

- the mixed company will own stocks in one or more subsidiaries, but will also be in charge of managing its own operations;

- the immediate holding company is an entity that holds voting rights or stocks in another subsidiary company of its own;

- the intermediate company which both a holding company and a subsidiary of a corporation.

In most cases, intermediate companies of holdings operate in the publishing sector in India.

Benefits:

- Liability Protection: The liability of the subsidiary company is limited to the extent of money that they have invested in the business. This means that is the profits of a company have been moved to the holding company, they are out of reach for the creditors. Also, it needs to be noted that in many jurisdictions, the profit transferred between the two companies may be tax free. This is because this amount is transferred in the form of dividends and dividends are tax free in most parts of the world. The holding company structure allows the parent company to lend back the same money that was received as profits. The money can be lent out in the form of a secured loan. In some cases, the subsidiary companies enter into agreements with the holding company. These companies give the holding company, the priority right to seize the assets of the subsidiary company in the event of a default. This structure allows the company to protect the interest of its shareholders over the interest of creditors. It is for this reason, that this structure has been considered to be controversial and many lawsuits have been filed citing the misuse of this structure.

- Tax Benefits: There are many states in the United States which provide favorable tax regimes to business. Delaware and Wisconsin are considered to be prime examples of such states. Hence, companies tend to register their holding companies in such jurisdictions where the tax rate is relatively low. In some cases, multinational companies prefer to register their holding companies in offshore tax havens like the Bahamas or the British Virgin Islands. However in India many regulations exist to control such tactics viz Deal between two associated enterprises at arm’s length price, GAAR, etc.

Limitations

- Difficult to raise fund: Banks and other creditors have become aware about how the holding company structure is used to avoid pay creditors their due. As a result, they tend to be very careful while loaning out money to subsidiary companies. The funds provided are often provided at a high rate of interest to compensate for the probable loss that may arise because of lending out to companies who have already mortgaged their assets to a holding company.

- Anti-Trust Laws: Holding companies have been used to create invisible monopolies in the past. As a result, regulators regularly keep a check on these companies to ensure that they are not creating a monopoly. In some cases, this leads to harassment as the company is not allowed to expand their operations easily.

- High cost of compliance:Usually the holding company structure is used by multinational companies or other companies which have a huge asset base. As a result, the regulations and compliance norms related to holding companies tend to be fairly detailed.

Main characteristics of the Indian holding companies

The main purpose of an Indian holding company is to perform investments in other companies, which are referred to as operating companies. As a general rule, a holding company may perform the following activities:

• Borrowing;

• Lending;

• deciding on the Investment policies of its operating companies.

It is important to know that in India, just like in other jurisdictions, a holding company is not entitled to complete commercial activities. This type of company is usually incorporated by businessmen due to its tax reduction schemes and asset protection regulations.

One of the assets that can be held by holding companies is represented by Indian trademarks and other intellectual property rights.

The subsidiary of a holding company in India

When considering the creation of a holding company, local and foreign investors need to know that their venture will have one or more subsidiary companies that will be subordinated to it.

The Indian holding company will:

- control the subsidiary through by being part in the Board of Directors;

- control the subsidiary through the funds it has invested in the subsidiary under the form of capital;

- hold more than half of the shares and share capital in one or more subsidiaries;

- the Board of Directors of the subsidiary will also be controlled by the parent company.

It is also possible for a subsidiary to exercise control over other companies, case in which these companies will automatically become subsidiaries of the parent holding company.

Purposes of holding companies in India

Large enterprises registered as holding companies can decide to branch out through subsidiaries in India, but also other countries in the world for various reasons. Among these, the most common are:

- the separation of various activities of the holdings;

- for tax planning reasons;

- for regulatory reasons.

It is not unusual for holding companies to develop activities in other countries if they have multiple operations in various industries. The holding can hold a major interest in independent companies and through their activities, each business line is clearly defined with the purpose of obtaining higher profits. Also, the shares in some subsidiaries can be listed on the Stock Exchange in India or other countries, case in which the profits of the respective entities must be evidenced separately.

Tax planning is another reason for a holding company to create more subsidiaries. This is mainly the case of foreign holdings who can expand their activities in India through one or more subsidiaries that can act on their own and which, compared to branch offices, will not depend entirely on the parent company.

There are also situations in which in order to operate a company must be created as an Indian holding instead of any other structure. This can be imposed through specific provisions of the Company Law, for example.

Another option is for holding companies to enter joint venture agreements with experts in various fields for the purpose of completing certain activities.

The holding company can bring many benefits for foreign companies deciding to operate in India, however, if you are a sole investor looking to do business in this country, you can rely on our company registration representatives for guidance in incorporating another type of entity.

FAQ

- When is a holding considered a resident company in India? Ans. In order to be considered a domestic company, a holding must have its legal seat in India.

- Can foreign holding companies operate in India? Ans. Yes, foreign companies can set up operations in India through one or more subsidiaries.

- Can an Indian holding company expand in more than one country? Ans.Yes, holding companies registered in India can expand their operations in several countries in which they have one or multiple interests. Moreover, they can set up more subsidiaries in one country.

In case if you have any further question for your structure planning or company formation or Tax planning, You may write us info@thecadesk.com